(BPT) – Paid Content by Vanderbilt Mortgage and Finance, Inc

Building a savings account can seem daunting. Many people believe they should have a high amount of savings tucked away, but then often become overwhelmed thinking about that goal. By shifting your mindset and taking small, achievable steps, you can reach your savings goals and more.

Keep in mind, if your savings is low or nonexistent, you’re not alone. Fewer than 40% of Americans could pay an unexpected $1,000 bill with their savings, according to a recent survey. The pandemic has presented countless challenges for many people, and even if you tapped your savings to make ends meet, you can always restart and refocus.

The good news is there are simple steps you can take to establish a savings account and help you reach other goals like a down payment on a new home, or extra payments on the principal balance of an existing mortgage loan. Vanderbilt Mortgage is happy to share its 2021 Home Loan Guide created to help educate and prepare homebuyers for a mortgage.

Here are three simple steps to start a successful savings plan:

Set a realistic goal

It may not be realistic for you to start saving $500 a month, but that doesn’t mean you can’t save an amount that makes you comfortable. Consider $50, $25 or even $5 if that sounds reasonable. Starting with a small, realistic goal can help you stick to a savings plan. Tracking your goals builds excitement, whether that’s for an emergency fund or to buy a new home. Visibly seeing progress reinforces your goals and you can be proud of building momentum.

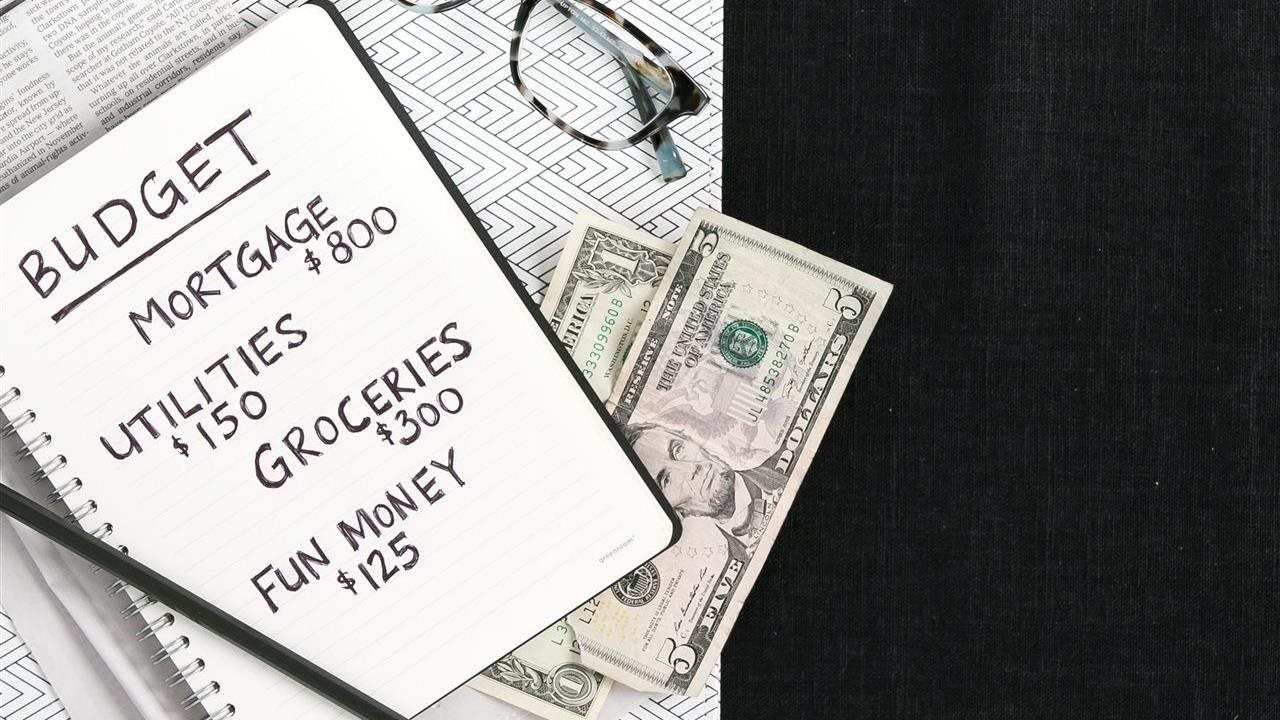

Create and stick to a budget

There is power in knowing the exact amount of money coming in and going out each month, so budgeting is an essential step in understanding your finances and guiding your saving efforts. If you budget and find a surplus, consider using that extra money to bolster your savings. If there is a deficit, reevaluate and decide what adjustments can be made. Understand necessities versus nice-to-have expenses and find ways to make your money work for your situation.

Know your “why”

Building a savings takes time, but having a motivation for your commitment can support your success. Whether it’s to have a safety net or you’re saving for a down payment on a home, a goal can help keep you focused, which means you are more likely to follow through.

If you’re interested in buying a new home, you might not need as much down payment as you think. Apply now at Vanderbilt Mortgage and learn about financing programs that fit your budget. If you already have a loan with Vanderbilt, consider paying ahead or even paying extra towards your principal balance; this will help you pay your mortgage loan off earlier.

These three initial steps can give anyone a guiding start to building a savings account to help them reach their goals. To access the 2021 Home Loan Guide and to get more details about smart steps you can take to save, visit www.vmf.com. Remember, just like a runner needs to train from completing a mile to completing a marathon, the best way to build a savings account is with consistent, achievable steps.

All loans are subject to credit approval.

Vanderbilt Mortgage and Finance, Inc., 500 Alcoa Trail, Maryville, TN 37804, 865-380-3000, NMLS #1561, (http://www.nmlsconsumeraccess.org/), AZ Lic. #BK-0902616, Loans made or arranged pursuant to a California Financing Law license, GA Residential Mortgage (Lic. #6911), MT Lic. #1561, Licensed by PA Dept. of Banking. Equal Housing Opportunity.