(BPT) –

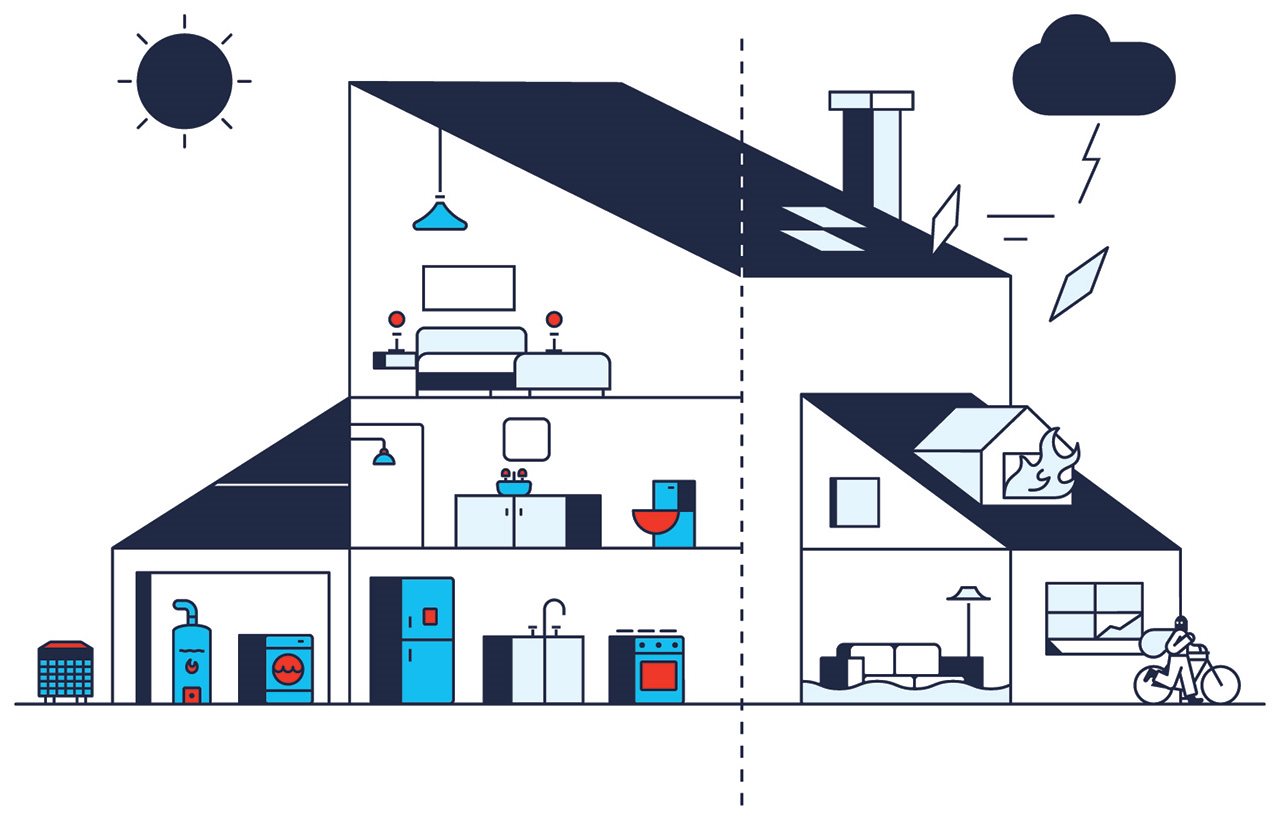

You might be wondering: what’s the difference between homeowners insurance and a home warranty (also known as a home service plan), and why do I need both? Especially if you are new to homeownership, the terms might be confusing. Put simply, homeowners insurance protects against things that might happen, while a home service plan protects against things that will happen.

For example, homeowners insurance covers things that could happen while you own the home, like:

- Natural disasters

- Theft

- Fire

Homeowners insurance also provides liability coverage in case someone is injured on your property.

But a home service plan covers things that will happen eventually due to normal wear and tear. It’s only a matter of time, such as:

- Appliance malfunctions and breakdowns

- System breakdowns (such as HVAC, electrical or plumbing)

Here are some benefits for homeowners who have both homeowners insurance and a home service plan.

1. Homeowners Insurance Protects Against the Unexpected

Typically, having homeowners insurance is mandatory. Most lenders will require you to purchase homeowners insurance when applying for a mortgage loan, and for good reason — it protects the investment you’ve made. Having up-to-date insurance gives you peace of mind in case of possible events like a fire, theft or storm damage.

2. Homeowners Are More Likely to Use Their Home Warranty

All appliances and systems eventually need repair or replacement. These are costs not covered by homeowners insurance. A home service plan, is a year-long, renewable agreement that protects home systems and appliances when breakdowns occur due to normal wear and tear. It helps cut costs of repairing or replacing many systems and appliances in your home, protecting things homeowners insurance doesn’t. For instance, American Home Shield plans cover up to 23 home systems and appliances, regardless of their age. When comparing 2020 American Home Shield claims data to reporting from the Insurance Information Institute, homeowners were 28 times more likely to use their home service plan than their homeowners insurance.

3. Your Budget May Not Be Able to Handle Repairs

When a system or appliance your family depends on breaks down, it can lead to serious issues and put a significant financial strain on your household. Even though these kinds of repairs are unavoidable, a recent AHS survey showed that one in four homeowners don’t have enough money set aside for them. A home service plan starts at $50 a month and has the potential to save you thousands of dollars on costly repairs or replacements. Common items covered by home warranties include kitchen appliances, washers and dryers, HVAC, electrical and plumbing systems. Within the first year of homeownership, the most common service requests are for air conditioners, plumbing leaks, water heaters and refrigerators. A home service plan may be especially helpful for homeowners on a fixed budget, recent or first-time home buyers, and owners of older homes.

4. Home Warranties Are Customizable

With a home service plan, homeowners can tailor their coverage by choosing from a variety of options to suit your household, as well as including add-ons. For example, you can add on coverage for additional systems like a pool or spa, guest units, etc. Some plans also offer discounted rates on routine maintenance, such as a pre-season HVAC tune-up.

5. A Home Warranty Company Provides Vetted, Professional Service

Homeowners should look for a well-established home service plan provider with experience and transparency in their coverage terms, service procedures and pricing. It’s also important to understand how the provider handles service requests. For example, American Home Shield uses a nationwide network of thousands of local licensed contractors who have been evaluated and reviewed. Experience counts: They respond to over 4 million service requests annually, so there isn’t much they haven’t seen or taken care of.

“A home service plan is the perfect complement to your homeowners insurance, as it provides repairs or replacement at a lower cost or no additional cost when normal wear and tear causes appliance or system breakdowns — which insurance won’t cover,” says Raj Midha, senior vice president for American Home Shield. “Many plans may also cover discounted maintenance services to ensure everything is working properly, giving you peace of mind.”

To find a plan that’s right for you, visit AHS.com.