(BPT) – ‘Tis the season to get wrapped up in preparation for gatherings and festivities. However, ensuring the safety of your home, guests and personal finances should be a priority. Fire, water damage and burglary claims often spike around this time of year, according to Mercury Insurance.

“Holiday gatherings appear to be back to pre-pandemic levels and hosts should be thinking about what all of this foot traffic means for their home,” said Bonnie Lee, Mercury Insurance vice president of property claims. “Homeowners should not only be vigilant about areas around the home that may need a tune up for the holidays, but also be aware of what their policies will cover.”

If you have plans to purchase expensive gifts or entertain guests over the holidays, review your homeowners insurance policy to understand how you may be covered.

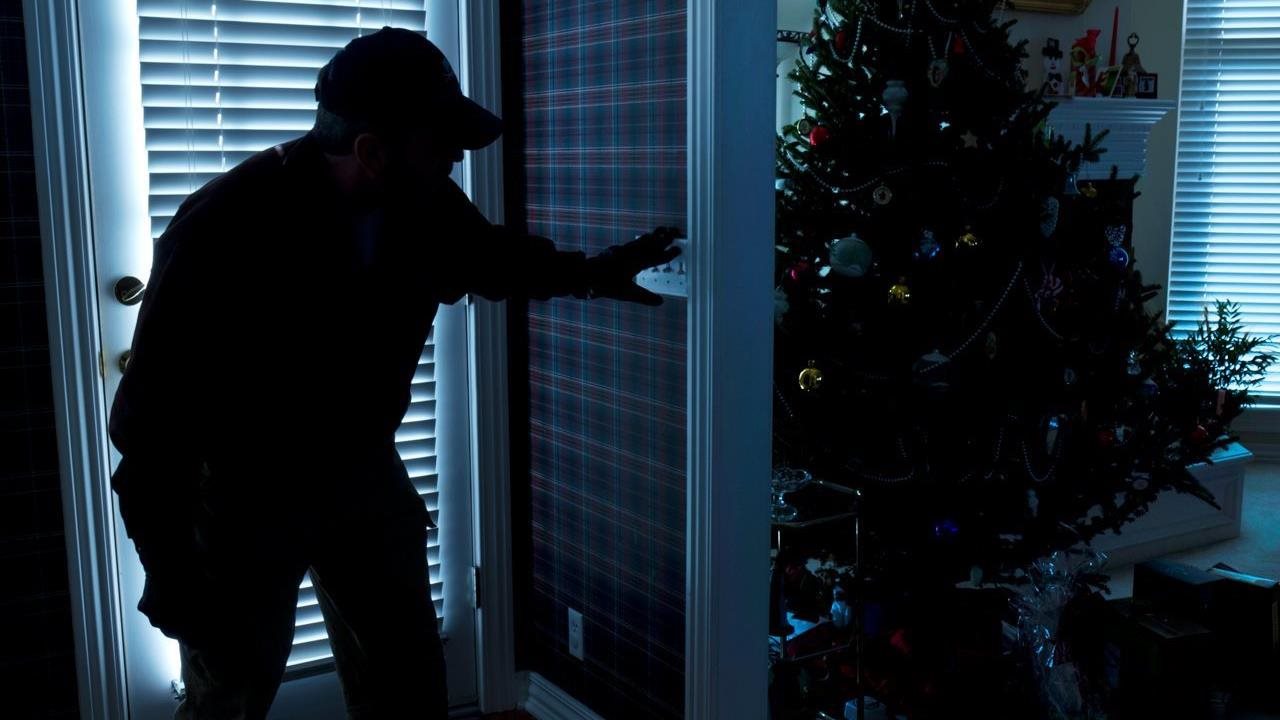

Theft

The holiday haze can interfere with awareness of potential risks. Break-ins and thefts increase this time of year since thieves know many families might be distracted with the busyness of festivities, or traveling and leaving their homes unattended. Homeowners can significantly reduce their risk by installing surveillance cameras, video doorbells, alarms, deadbolts and other types of home security. Some insurers may offer policies with a theft protective device discount.

“If you recently purchased an expensive gift, be sure that your insurance policy extends to cover such presents,” Lee said. “Homeowners policies often cover theft, so you’ll be able to file a claim with your insurance company should something happen, but it’s always a good idea to check your insurance policy to see how your personal property is covered, especially when it comes to high-end gifts.”

Protecting pipes from winter weather

If you live in a climate that is prone to wintery conditions, make sure the plumbing in your home is prepared before temperatures drop. Check pipes located in unheated spaces to ensure proper insulation to prevent freezing and bursting. Most policies cover sudden, accidental and short-term water damage from a broken pipe; however, policies typically won’t cover frozen pipe damage if the homeowner failed to maintain heat in the building, as reasonably possible, or to shut off the water supply and drain all systems properly.

If you have multiple bathrooms in your home, you know that some might get used more often than others. Once a week, make a point of turning faucets on and off and flushing toilets in bathrooms that get less use to ensure water continues flowing in the right direction.

Fires

Fires can be caused by a number of factors during the holidays, from cooking mishaps to open flames, like fireplaces and candles, left unattended. Fire insurance is typically included in your policy and protects the contents and the surrounding property, helping with the cost of replacing or repairing your home in the event of a fire.

Most lights, ornaments and other decorations are insured for damage from fire, vandalism or theft, but not against normal wear and tear. Make sure any cords or lights you are using for outdoor displays are made for outdoor use. Never overload extension cords or outlets and check all wires, cords and lights for any tears or damage before plugging them in.

Sewage backup

Sewage backups can quickly become a big mess. For example, a rainstorm could overwhelm a city sewer system making the water flow in reverse from the city sewer line to the homeowner’s sewer line and eventually into the home. Many carriers, including Mercury, offer an endorsement to homeowners insurance policies for this type of coverage.

“You can ease anxieties about what you may be held responsible for by reviewing what is covered by your homeowners policy with your agent before disaster strikes,” said Lee. “Notify your agent if you have made any significant changes to make sure your home is properly protected.”